Housing Market Update

Real Estate Regret (2nd Qtr. 2022)

Regret and Fear are twin Thieves that rob us of today- Rob Hastings

Is the market Crashing? Correcting? Shifting?

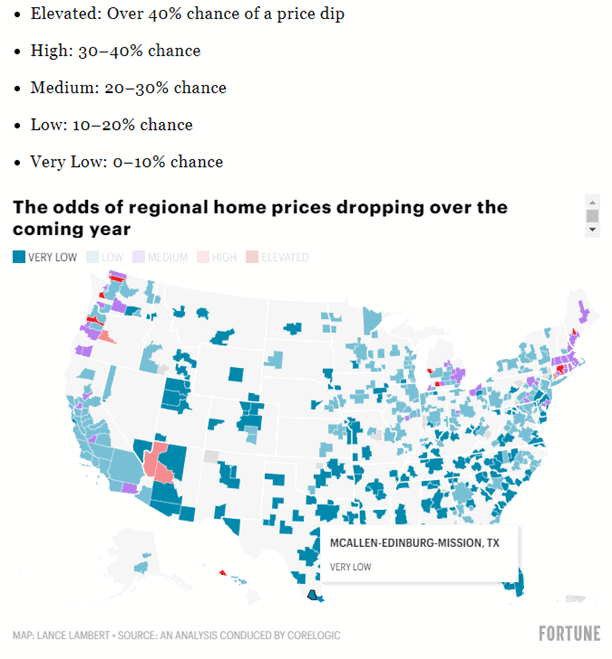

It is no secret the housing market is next in line to feel the economic impacts and the news is spreading like fire, stoking fear with articles such as, “Housing market is showing signs of correction”, “These regional markets could see housing prices drop”, and the “Housing market showing signs of correction”. The list goes on and on. The truth is we are certainly seeing an adjustment, correction and/or shift, but it is too early to say for sure the degree and the sentiment of it all. There are other factors to consider other than headlines, and where there is fear there is usually opportunity. My buyers and sellers have some amazing opportunities they can take advantage of in our current market. I have analyzed the data, news, local & national and will try and put everything into perspective form how I see it. See summery at the end to jump to my conclusion.

Brief

• Days on market are up, prices are dropping, more inventory, bidding wars are receding.

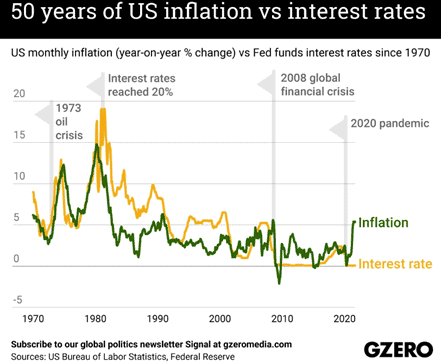

• Cause: interest rates hike, recession fears, housing unaffordability.

• Buyers opportunity to buy at lower/fair market values and refinance when rates drop later. Avoid bidding wars, overpriced homes, waived contingencies now.

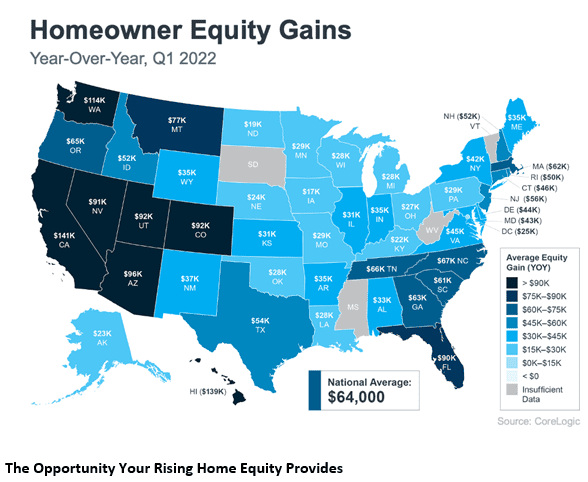

• Sellers capitalize on the year over year appreciation gains and capture the market peaks, and be able to buy at reasonable market values like noted in buyers above.

• Odds are the market is shocked and we should be returning to a neutral market for a short duration but likely will end up back in a sellers’ market eventually. Time is unknown though.

Real estate regret happens whether you:

● Went through the housing bubble of 2007

● Didn’t buy between 2010-2019

● Didn’t sell your home 2 months ago in a hot seller’s market

● Not capturing the “buy low, sell high” strategy

● Renters realizing how much money and equity you lost by renting for so long

● Hired the wrong real estate team

● Didn’t invest in that vacation rental

● Didn’t take advantage of that opportunity because of fear.

Whatever it is, there is opportunity in all things. You just have to have the right information and knowledge to make informed decisions. This is a time to get ahead of regret.

When it started

Mother’s Day weekend was when we felt the “shift” in the market locally. Agents were calling each other asking if they received any offers over the weekend or if buyers were attending open houses. The answer was the same from everyone, a resounding “NO”. Maybe it was simply a Mother’s Day weekend slump. However, the weeks that followed continued to show the same trend of disappearing buyers, more inventory , more days on market and then price drops.

The Visuals

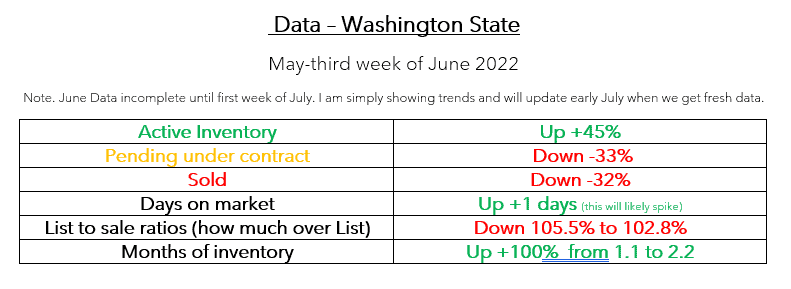

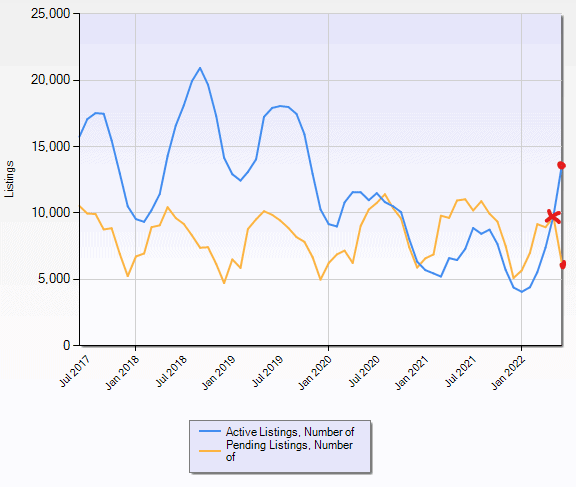

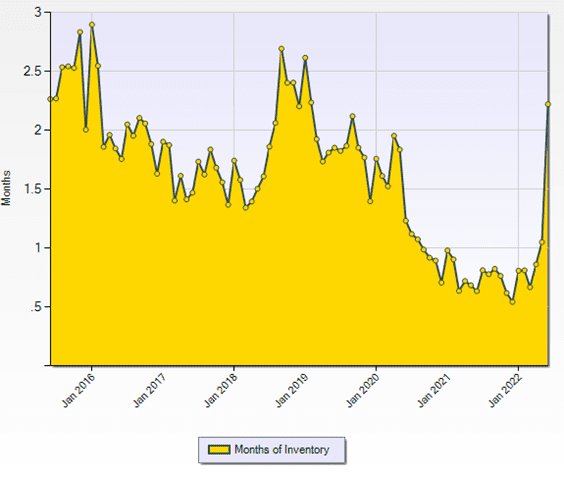

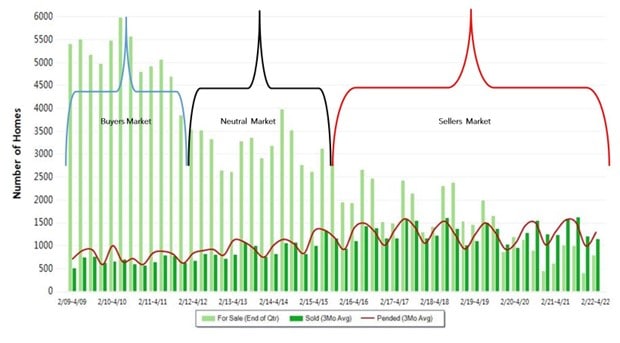

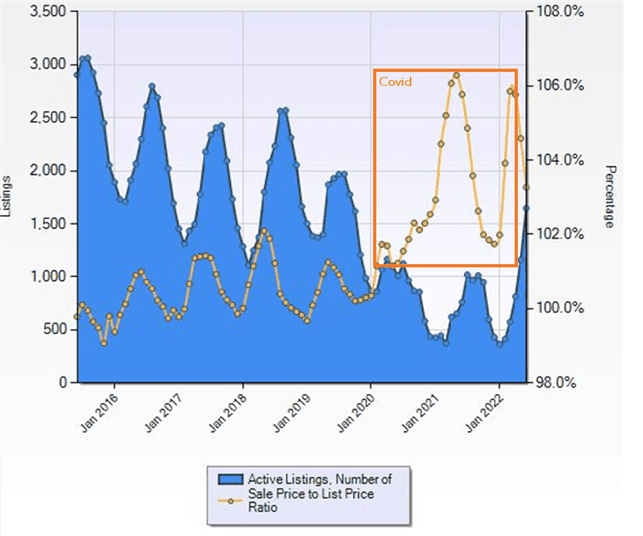

This will be the first time in at least 5 years we will see more active homes on the market than pending homes. This means a spike in inventory and less homes under contract.

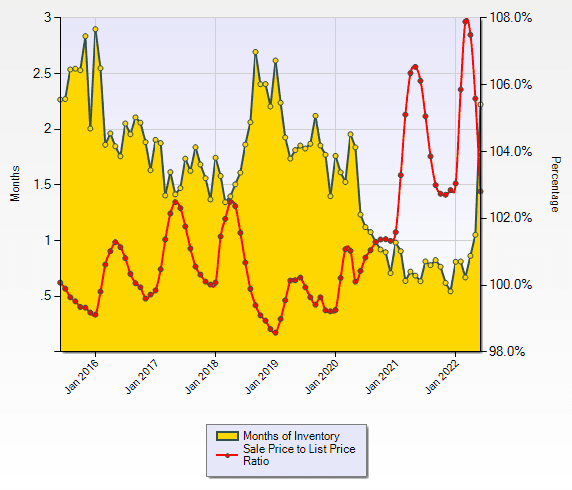

Charts are of Washington states data.

If the current trend stays true for July we will go from a roaring sellers’ market to nearly a neutral market in less than 3 months, but this also follows year over year trends for summer supply rising and tied with interest rate hikes and recession fears. What I am calling a shock to the market.

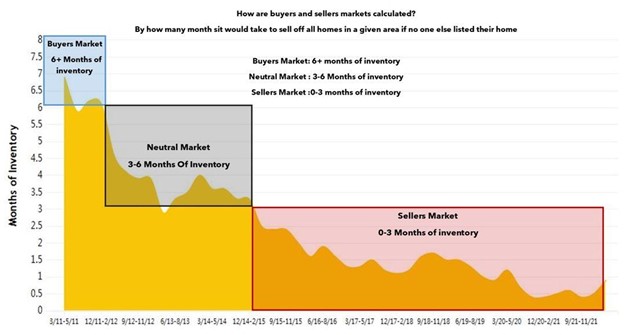

The markets are defined as:

● In a buyer’s market houses last on the market for 6 months or more. There is more supply than demand for homes

● In a neutral market the number of buyers and homes on the market are equalized. The average length of time a home may be on the market ranges from 3-6 months

● In a seller’s market houses can sell quickly from 0-3 months on the market. The demand for homes exceeds the supply of houses on the market

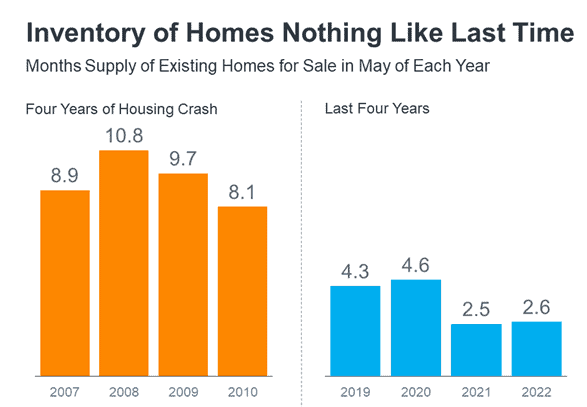

However this is one of the main points why we are not in a housing bubble. We simply are short on housing inventory (national average).

The list price to sale price ratio illustrates how much over or under a home sells for in comparison to the initial list price. For example, if I list a home at $500,000 and sell it for $525,000 this would mean a 105% list to sale ratio.

The Causes

The main contributing factors are:

● Soaring home prices, maxing out home buyers budgets.

● Abrupt interest rate spikes.

● Fears of recession (And our hidden opportunity)

Soaring home prices and affordability

house prices and bidding wars for the last 2+ years has made buying a house for many unaffordable or buyers are unable to compete against other home buyers. However, low interest rates made it more palatable at the time, while at the same time pushing the limits of affordable housing.

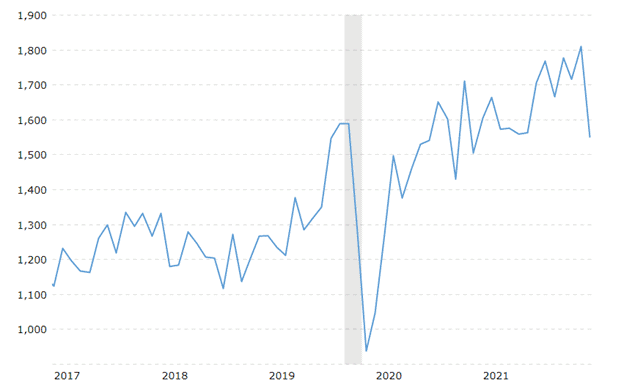

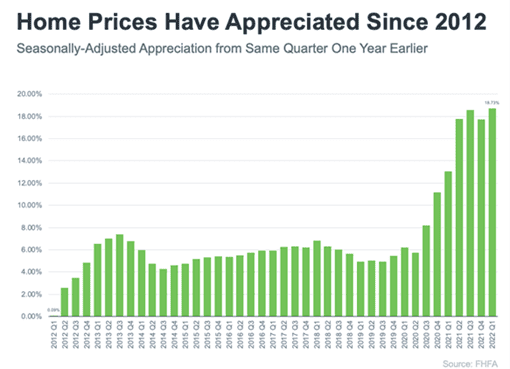

Perspective: The chart below shows that the biggest unobtainable spikes were during the pandemic. Interest rates and fears may be what we need to return to a balanced neutral market which is a good thing for everyone. Inventory rising gives balance.

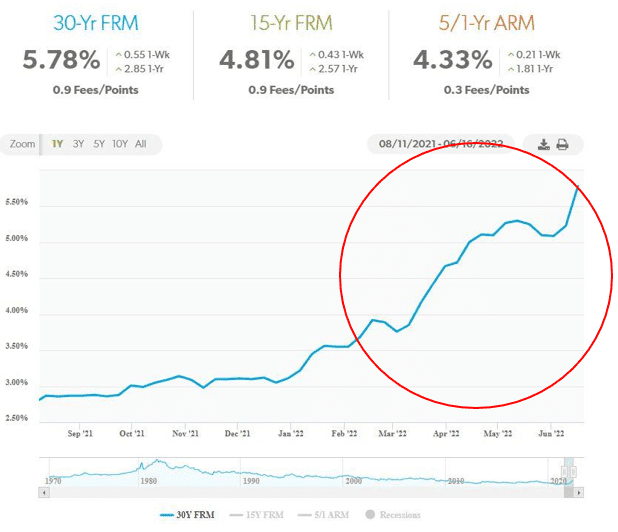

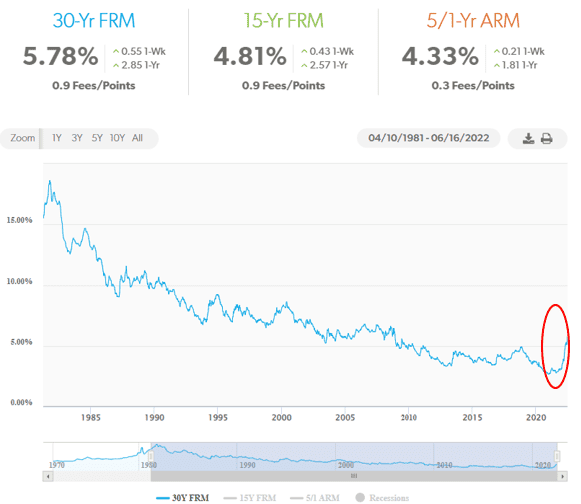

Interest Rates Spikes

began to rise in late January going from roughly 3% to doubling very quickly in the last month to nearly 6%. The effect immediately forced some buyers out of the market and unable to afford a home (every 1% increase in interest rates cuts 10% of buyers purchasing price/power)

Perspective: Interest rates are still lower than what they were in August of 2008. And here lies our opportunity. See more below.

Buyer and seller Opportunity: If you are able to buy now at affordable prices you can refinance later as recession/ interest rates cool. Recessions typically last 2-5 years. The same amount of time on average people refinance.

Fears of a Recession.

Everyone gets financially conservative when they hear the word “recession”. However, with fear driven real estate regret house hunters are left saying, “I wish I would have bought when the markets were down.”

Perspective: The greatest investments during a recession/depression are tangible assets like real estate, gold, bonds and ironically the three basic necessities of life: food, clothing and shelter.

The Reality

Houses are likely not going to drop in prices. Most experts agree that we won’t see a housing bubble. We simply do not have enough houses to accommodate our growing society, new generations buying such as millennials and Gen x just getting started. influx of immigration and builders are not keeping up with the growth and demand.

This chart & article delves deeper into the issues surrounding new construction and how housing starts have fallen again last few months amid recession. So housing shortage will continue.

The Future

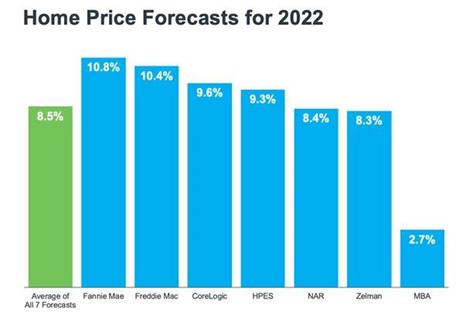

What we will likely see in the future is a deceleration and slow appreciation (how much a house gains a year or given time just by market growth). Historically, appreciation was 4% until the end of 2019 when the pandemic made them skyrocket to as high as 18%. It is projected that appreciation will fall back to an average of 8.5%.

Perspective: 8.5% is still a good return compared to historical norms. But again demand may very well in the future force them back up higher.

Check out this interactive chart on Fortune.com.

The Bottom Line

We have been spoiled with low interest rates for buyers for years and soaring appreciation for sellers for the last 2-5 years.

Aside from an all out collapse of the economy, world war III or a meteor strike, I firmly believe we are correcting and returning to the 2019 pre pandemic levels. Right now I am calling this a shock to the market with abrupt interest rate hikes, recession talks on already squeezed buyers, all within a short time span. This will likely subside and buyer will be forced to accept the interest rates for a few years until recession subsides. At which point you can refinance. How long it will take is hard to say.

The charts above show massive demand occurring when Covid hit and the two years following, but also showed demand growing steadily prior to the pandemic. We still have a housing shortage problem. More people +less properties = crazy sellers market. Developers and builders haven’t been building at a pace to make up for lost time when builders put on the brakes during covid (supply chain issues, labor shortages, etc) and now slowing again for fears about a possible recession.

I feel we will approach a neutral market for a small period of time then return to a sellers’ market. Buyers will realize the current rates are still historic lows and with room to refinance later when recession control subsides which is about the same time average people end up refinancing. Better to get in now then bidding wars that may return.

Rents will likely continue to rise and we will still be experiencing a housing shortage as corporations keep eating up lots of inventory to rent out.

You can refinance, but you can’t change the price you paid after a bidding war on a home you probably didn’t like that much, waived inspection, paid 5-20% over asking price and drained your savings account on avoiding a low appraisal or paying a hefty down payment.

You also need an agent who has been through buyer’s, neutral and seller’s markets. Who has the experience to know what they can get out of sellers in times like these or know the strategies of other buyers agents and how to go up against them.

In the last two months we have been able to get $70,000+ off the asking price, three buyer’s closing costs have been paid by the seller, negotiated two new roofs and roughly $15,000 in other repairs paid for by the seller, and a $25,000 solar panel all paid by the seller. And we are just getting started.

Sellers Note:

In our current market seller’s can take advantage of more options for your move and sell before you have more competition. Many sellers regret not selling in March or April as I suggested, but it is still a seller’s market and you are still in the opportunity zone to make a massive return on your home. Before you enjoyed 16% annual appreciation on top of bidding wars, waived inspections, etc. It will likely recede to 8% and you will have to now deal with buyer demands and contingencies. The peak of the seller’s market for the last two years was approximately May 8th. We are seeing the tide recede, but for how long is hard to say. This is also a great opportunity to capture your gains over the last 2-5 years of appreciation and equity and go after that larger home, downsizing or retirement home and temporarily have a high interest rate without the intense bidding wars.

Sellers absolutely need an experienced agent who is savvy in all markets (buyer, seller, or neutral). Proper pricing is paramount in this market, so I can compete against other realtors who fight like I do for buyers. One who can analyze data and fight with numbers. Marketing is also important. Not just putting your home on the MLS and putting a sign up in your yard. Proper pricing tied to quality marketing is a recipe for a successful home sale.

Get a copy of my new home selling guide here.

I hope you find some comfort in my report being a buyer or seller. I honestly feel we have a window of opportunity to suit both sides right now and a breather per say. However i do not hold a crystal ball. If you have any questions comments or just want a trusted real estate team to get to work for you and give you valuable insight like this. connect with us anytime We would be honored to help.

Note: I will be monitoring the markets and update everyone to any significant changes when we get the new data in 5-10 days when the MLS gives us the data.

Who We Are

From selling your current home to navigating through the home buying process, relocation & real estate can be challenging. Being a disciplined and structured Veteran knowing the obstacles of real estate, I established Soldiers Agent Inc. in 2011 helping veteran & active duty, rebranded now as Veterans Agents to serve our entire community.

We are a full time full service team filled with certified, professional, experienced personnel who not only support the military community but everyone within our communities giving you not only a professional leading real estate team but one with core military ethics/morals/values/integrity, Structured & disciplined, Accountable and much more to give you superior service.

Real Estate is ever evolving, and you need a team evolving with it. We will make sure your needs are met with devoted, coordinated, tactful, and professional service.

Our entire team is proficient in hardline negotiating, immensely data and analytically driven, fair, diligent, and hold people’s feet to the fire, which is why our various services are incredibly successful. We have received over 200 positive reviews, which demonstrates our passion for providing exceptional service. Every team member was screened to ensure that we have nothing but the best experts in their field. From our lenders, inspectors, contractors, and others you can be confident that they are the best in our region.

With warm welcome, we are eager to be by your side!

Cyrus Bonnet

CEO, Broker, Veteran

Cyrus Bonnet & Jenna Huey

Est. 2011

253-766-5133

Cyrus@VeteransAgents.com

www.VeteransAgents.com

Formerly: Veterans Agents inc.

Contact us Click here or scan QR Code below

Verify us:

200+ Combined Positive Reviews | 300+ Closed Sales | $100M+ Volume | $100k Donated | Quick Save My Contact Info |