Housing Market Update

Real Data Analyzed

By Cyrus Bonnet

“Beware of Fear-Mongering Influencers: The Housing Market Reality”

In the era of YouTube, Instagram, and other social media platforms, it’s essential to tread carefully when it comes to the information you consume. Many influencers are quick to sensationalize the housing market, capitalizing on the drama to boost their viewership, likes, and follows. After all, nothing grabs attention like a good dose of doom and gloom. Are we currently facing challenging times in the housing market? Undoubtedly. The crisis is real, and housing has become unaffordable, interest rates have skyrocketed to levels not seen in 23 years, and global tensions are escalating. It’s enough to make anyone anxious.

These influencers are skilled at delivering charismatic presentations and reading carefully scripted bad news articles, inundating you with statistics and numbers from various corners of the country. However, it’s important to remember that they often concentrate on specific markets experiencing hardships.

If you’re in the market to buy or sell, you’re probably feeling uneasy. Selling your property may mean you’re looking to buy another, and that’s no easy feat in the current climate.

But here’s the bottom line, as clear and precise as it’s always been in my past market updates: We’re in the midst of a housing shortage crisis, at least in most parts of the US and certainly in our region of Western Washington. Even if interest rates were more affordable, we’d still be grappling with a housing shortage crisis. And when rates eventually drop, brace yourself because the affordability crisis won’t be caused by interest rates alone. It will intensify due to escalating prices and fierce bidding wars. Minus any economic collapses world wars, covid 2.0’s etc.

Listen to the Experts

So, don’t just take my word for it or rely on the fear-inducing influencers. Listen to the true professionals in the field. Would you rather heed advice from Dave Ramsey, the chief economist of the housing industry for NAR, the CEO of the largest mortgage holding company in the US – UWM Mortgage, Barbra Cochran and more who have the credentials and experience?

Or, would you prefer to follow some of the top YouTube and Instagram influencers who lack financial certifications, education and backgrounds? To help you make an informed decision. We’ve provided links to the latest videos from these leading experts in the field. It’s time to separate fact from fear, and rely on those with a deep understanding of the market dynamics.

This first Video is of Chief economist for the national association of realtors Lawrence Un. in summery we have a sever housing shortage and we need more building to occur.

Dave Ramsey explains supply and demand and how prices will go up. Housing prices are likely to go up.

CEO of United Wholesale Mortgage. The largest mortgage holding company in the US. People are still buying.

This agent in Texas does an absolutely great job explaining what I have been and am trying to portray this whole year.

Why the Housing Market Won’t Crash, But Challenges Persist”

In a world of economic uncertainty, one thing is clear: the housing market is not on the verge of a 2008-style crash. In fact, the opposite seems to be happening. However, this doesn’t mean it’s all smooth sailing. Unaffordability is becoming a significant concern due to a combination of factors, including a severe lack of housing inventory and interest rates that are unlikely to return to the attractive levels of 2021 (2.75%) anytime soon.

As reported by Fox News, Federal Reserve Chair Jerome Powell is expected to maintain the current course, which may involve further interest rate hikes. This suggests that we won’t see a return to historically low rates in the foreseeable future. Other experts predict we wont see any significant rate drops for years to come.

To address the housing crisis, we need a massive surge in construction, foreclosures, or, conversely, a substantial drop in population. Currently, we’re grappling with a housing shortage of 4 to 6 million units, a situation that’s only worsened by additional challenges.

Resale Demand Slows

A significant issue with the housing shortage is resales homes are greatly slowed. This is due to baby boomers are more inclined to stay in their paid-off homes, while Generation X is approaching the payoff stage of their mortgages and lower interest rates. Millennials are also content to stay put, thanks to historically low interest rates when they purchased, leading to a shortage of the resale market.

Builders are working diligently to increase housing production, but we’re still facing a massive shortfall of 4 to 6 million units. Additionally, the influx of over 2.5 million immigrants, both legal and illegal, further strains the need for housing. Generation Z is entering the housing market, and multigenerational living has risen to 18% as of 2021, as many are waiting to venture out on their own.

Amid these challenges, there are potential solutions on the horizon:

- Government Action: Government intervention is crucial. Reducing bureaucratic red tape and lowering building costs for builders would expedite construction. Offering tax incentives to investors who release housing inventory could also help alleviate the housing shortage.

- Regulating Corporate Home Buyers: Curtailing corporate home buying companies’ mass purchases can prevent market manipulation and help regular homebuyers find affordable properties.

- Embracing Multifamily Units: To meet the growing housing demand, investing in more multifamily units, such as apartment complexes and multifamily housing, is essential. These options cater to diverse living needs and can help address the housing crisis.

While the housing market may not be on the brink of a crash, there’s no denying the pressing issue of affordability and inventory shortages. By taking action and implementing common sense solutions, we can work towards a more balanced and accessible housing market for all.

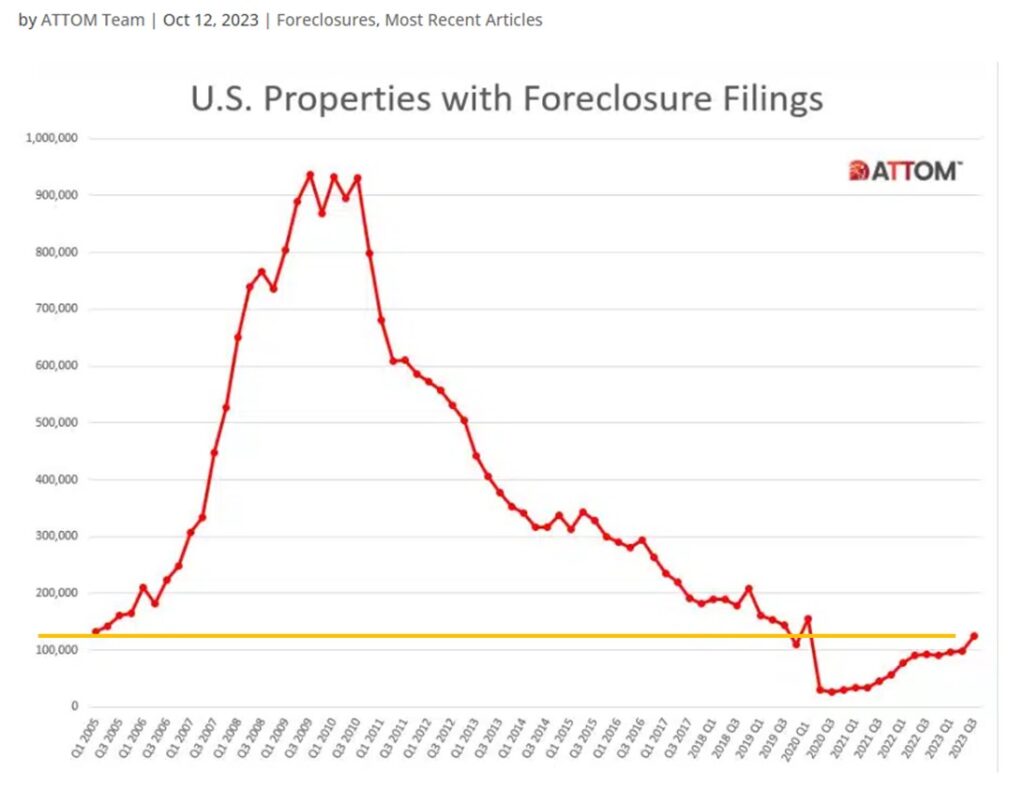

Foreclosures:

In the real estate world, many buyers hope for a surge in foreclosures to bring down housing prices amid the ongoing crisis. However, the reality is that most homeowners have significant equity, making mass foreclosures unlikely.

As inflation persists, foreclosure rates are expected to rise, as shown in Attom’s chart below. But three crucial factors should be considered:

- We’re in a better position compared to the 2008 housing crisis; foreclosure rates are lower.

- Effective loan modification and foreclosure prevention programs are in place.

- More investors and corporate entities are entering the housing market, limiting opportunities for the average buyer.

What to fear

There is a prevailing consensus among experts that should we witness a significant wave of job losses, we may find ourselves in a troubling predicament. This scenario would usher in a new narrative and reframe our analysis of the situation, inevitably pushing those already on the financial brink over the edge. With many individuals struggling to make both ends meet and savings rapidly depleting, the specter of increased housing inventory and a surge in foreclosures becomes a worrisome reality. While the presence of numerous investors in the market may serve as a mitigating factor, we can only hope that such a scenario never comes to fruition. It’s important to recognize that this is far from an ideal situation, even for those eagerly looking to enter the housing market. In these uncertain times, it is crucial to remain vigilant and adequately prepared for the challenges that may lie ahead.

If we have a recession/depression it will not be due to the housing market like last time. it will be an entire economic issue.

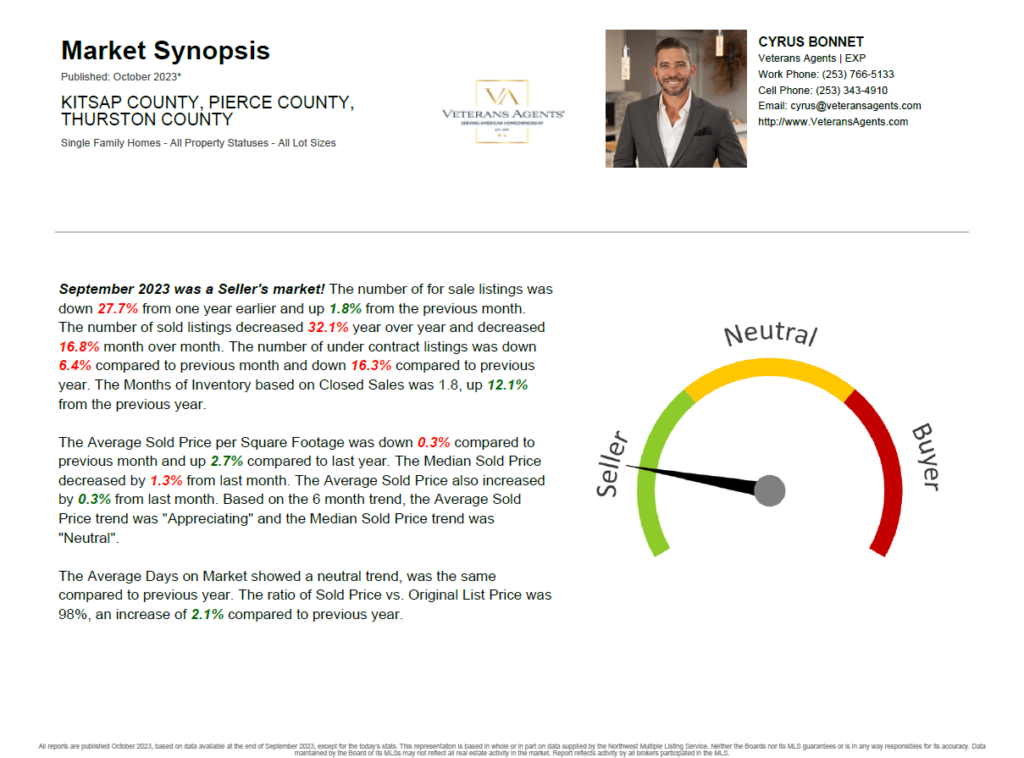

The Local Data

Pierce, Thurston, Kitsap Counties

As i explained in previous market updates I was confident in the coming housing shortage that i was seeking more home myself and i did end up buying only one and flipping/holding it. I will refinance it later as my rates as an investor are near 8% 4 months ago. I anticipate appreciation to rise close to pandemic levels of 15-18% when the bidding wars return.

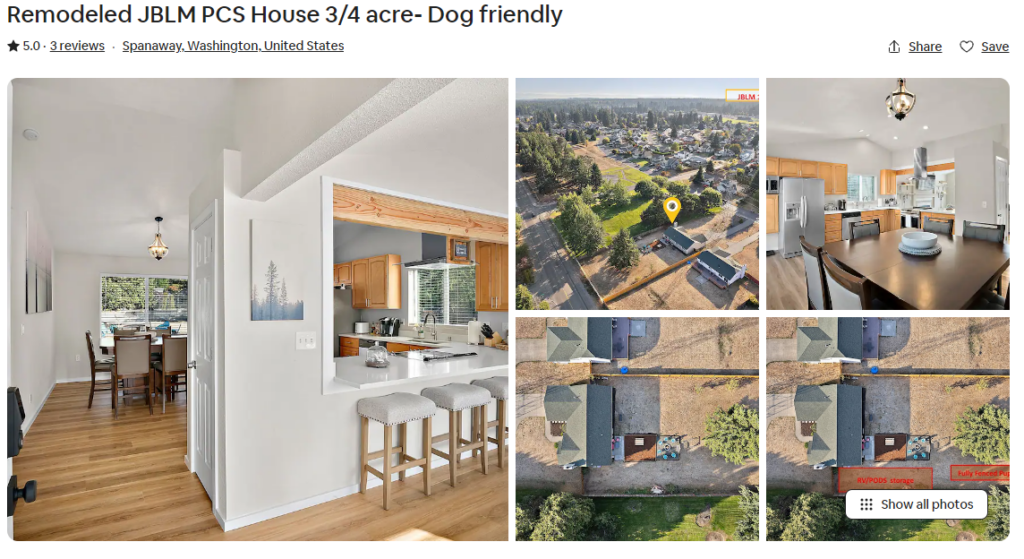

If you or anyone you know is in need of temporary housing you can find my new home on Air BNB Here.

Mortgage Rates Update +-

Rates unfortunanly have been on the rise the last few weeks. and experts predict they are here to stay for some time.

Mouse over and click Interactive chart for today & past rates (Turn phones sideways)

Mortgage News

Bank Rate –Expert predications on Interest Rates

Some Mortgage Loan Relief

“For years, we’ve partnered with top lenders to secure the best rates and fees for our clients. We’ve always encouraged shopping around for mortgages to find the most favorable terms and relationships. While we still stand by that principle, we’ve recently taken steps to make the process even easier for you. We’ve introduced two mortgage brokers who often offer rates up to a full point lower than many lending institutions, and they don’t charge origination fees. Their primary job is to scour multiple mortgage companies to find you the best rates. In fact, most of our clients choose to work with our loan brokers after shopping around. Connect with them today to experience the difference for yourself.”

Tim Barlow Cornerstone Home Mortgage

360-250-3400

tim@cornerstonehomemortgage.com

https://www.cornerstonehomemortgage.com/tim/

Mark Jaimie – All Square Mortgage

253-691-3563

mjaimie@allsquaremortgage.com

National Housing News

- Yahoo Finance: Barbara Corcoran Says Housing Prices ‘Are Going To Go Through The Roof’: Here’s When

- CNBC: Home prices are expected to rise in 2024

- Fortune: Four years of housing market gridlock? Goldman Sachs issues U.S. home price predictions through 2026

Data Sites (live)

Summary:

If there is a recession or depression it will not be due to housing. there is no bubble. Housing is in crisis mode with rate sand low inventory and affordability no doubt. There is turmoil in the economy causing high interest rates and hardships that will likely effect the housing market but not a doom and gloom full collapse like you will see broadcasted by influences with no real backed education. Low inventory more population lack of growth in new homes we are very likely not going to see a housing bubble. Economics 101 supply and demand.

In today’s real estate market, we find ourselves amidst a backdrop of global and local uncertainties. While it’s natural to feel anxious, it’s crucial not to let fear-mongering misinformation from media and influencers guide important decisions. Remember to approach media information with a critical eye, using logic, common sense, and thorough research to make informed decisions. how experienced are they? What are their credentials?

It’s important to remember that people still need to buy and sell homes for various reasons such as divorces, corporate or military relocations, and estate settlements. Currently, the market might appear to be in a seasonal slowdown, as children head back to school and the holidays approach. Just like spring traditionally sees bidding wars and increased prices, these cyclical shifts are expected regardless of interest rates.

For buyers, despite the current competitive landscape with high rates and prices, there are ways to be well-prepared. Consider the advice of buying now, benefiting from future appreciation and equity, and then exploring options to refinance or sell.

Options:

- Use a mortgage broker who often have lower interest rates, fees and overall success then a mortgage lender with overhead.

- Buy down rates – we can negotiate seller pay for this in certain situations.

- Consider a 3/2/1 buy down. We were able to get one of our clients down to 3.75%

- Assumption loans are trending. Buy homeowners lower interest rate.

- Buy before you sell

Sellers should collaborate with experienced realtors rather than just real estate agents. Proper pricing and effective marketing are pivotal in today’s market. The best time to sell a house is typically from the end of February to the end of May. Those who have followed our guidance have often achieved successful outcomes. Consider a strategy of selling in the spring, temporarily renting until mid-summer, and then potentially buying in a more favorable market. For comprehensive guidance on your real estate journey, connect with us.

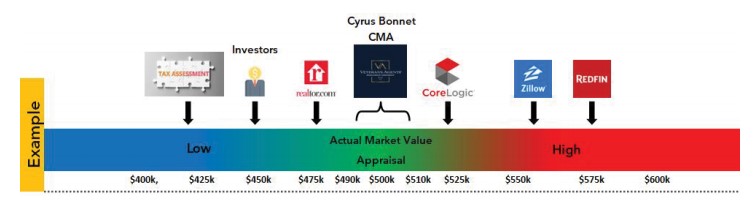

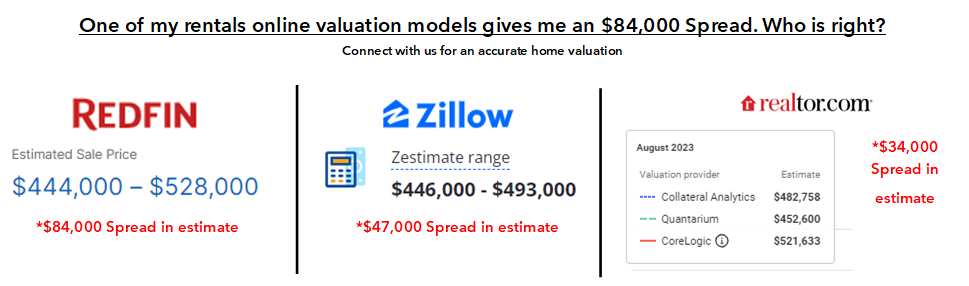

OVM’s Misdirection

In the world of real estate, major platforms like Zillow, Redfin, and other online valuation models (OVM’s) can inundate you with inaccurate or outdated information, leading to discrepancies of up to $100k in their home valuations. Each site varies significantly, making it essential to rely on a team of our expertise to guide you through the sea of misinformation. With our help, you can access reliable data and make informed decisions during the significant purchase or sale of your life. when looking at your home value online be sure to look at 3 different sites to see how far the spread is.

Online Valuation Models’ (Zestimate, redfin estimates etc) OVM’s

Amazing Real Estate Tools to Succeeded

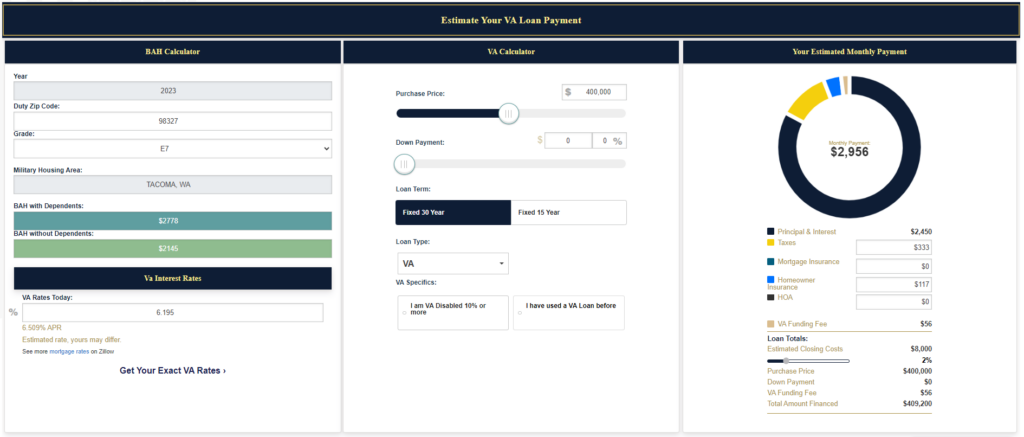

Ultimate VA Calculator

We are happy to announce our ultimate VA calculator.

All in one BAH Rates, Average daily VA rates, Mortgage calculator, mortgage payment estimator.

Homebot

Our Clients past and present love love love this app. Easy to use and very informative.

Homeowners Click Here For Access

NWMLS

You now have direct access to the MLS. Northwest MLS is the most advanced mobile app for residential real estate in Washington state and beyond. you no longer need outdated and inaccurate info from Redfin, Zillow, etc. these companies get their info from the NWMLS

Must use code to access: 967B592C

View our listings

Cyrus Bonnet | CEO | Broker | Veteran

12+ Years Experience

250+ combined 5 Star Reviews

$150M+ sold

$100k Donated

PSA- Pricing Strategist Advisor

MRP- Military Relocation Professional

Connect with us

Click Here to Meet with Cyrus: Zoom, In Person, or Call

Or

call: 253-766-5133

Email: Cyrus@veteransagents.com

Or lets us contact you