Housing Market Update

Real Data Analyzed

By Cyrus Bonnet

BE CAREFUL WHAT YOU READ!

Welcome to our housing market update! As we delve into the latest trends and shifts in the real estate landscape, it is essential to bear in mind a crucial piece of advice: Be discerning about the information you read and listen to. Gone are the days when the entire nation witnessed a uniform surge in housing demand and frenzied bidding wars, as we experienced during the height of the COVID-19 pandemic. Today, the housing markets vary significantly from state to state, with some cooling down while others remain overly buoyant. In light of this diversity, it is vital to avoid relying solely on national headlines, as they might inadvertently lead you astray.

In this blog, we will explore three different articles, each predicting the most stable markets, yet offering contrasting viewpoints. By doing so, we aim to empower you with a comprehensive understanding of the current real estate landscape, enabling you to make informed decisions regarding your housing needs. So, let’s dive in and uncover the nuances shaping today’s housing market, dispelling any misconceptions along the way. Remember, knowledge is your greatest asset when navigating the dynamic terrain of real estate.

CNBC – The 10 states with Americas most stable housing markets

CNBC predicted Utah as the most stable. Washing ton came in second.

Montly Fool – These will be the most stable housing markets in 2023

Motley Fool predicted Lake County, IL has the most stable. Washington didn’t even make it on the top 10

Construciton Cverage – The Most Stable US housing markets

Construction Coverage predicted Pittsburgh Pennsylvania has the most stable, Utah came in 11th, and Washington didn’t make the list

And this is all about the most stable housing markets. We are seeing a lot of fud in the news good, bad, scary, great, combining national stats that rent prevalent to us all over the place. Predictions on interest rates, housing collapses, best times to buy Etc. In this market update I’ll do my best to provide local data for you to make informed decisions with historics and trajectories to make an informed decision.

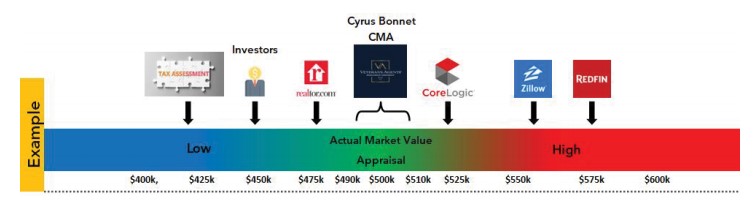

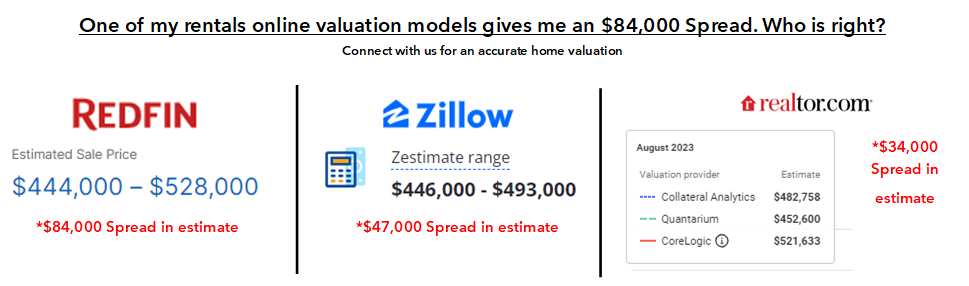

In the world of real estate, major platforms like Zillow, Redfin, and other online valuation models (OVM’s) can inundate you with inaccurate or outdated information, leading to discrepancies of up to $100k in their home valuations. Each site varies significantly, making it essential to rely on a team of our expertise to guide you through the sea of misinformation. With our help, you can access reliable data and make informed decisions during the significant purchase or sale of your life. when looking at your home value online be sure to look at 3 different sites to see how far the spread is.

Online Valuation Models’ (Zestimate, redfin estimates etc) OVM’s

Amazing Real Estate Tools to succeeded

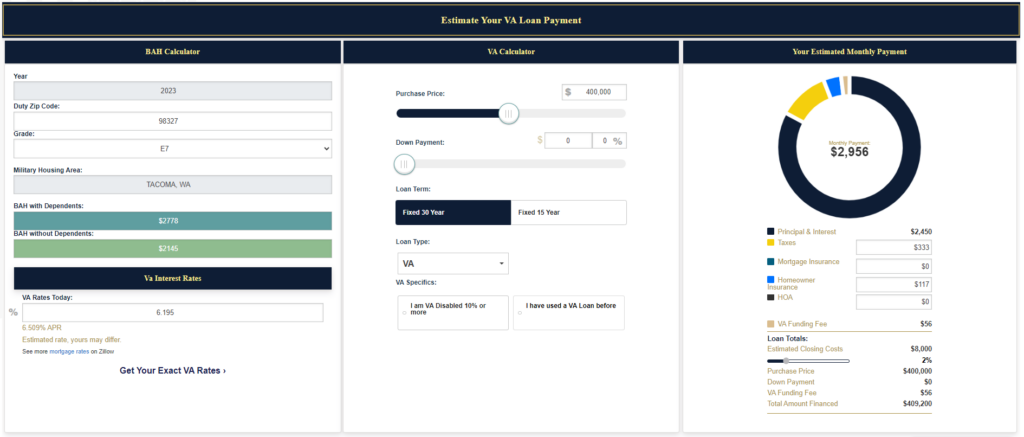

Ultimate VA Calculator

We are happy to announce our ultimate VA calculator.

All in one BAH Rates, Average daily VA rates, Mortgage calculator, mortgage payment estimator.

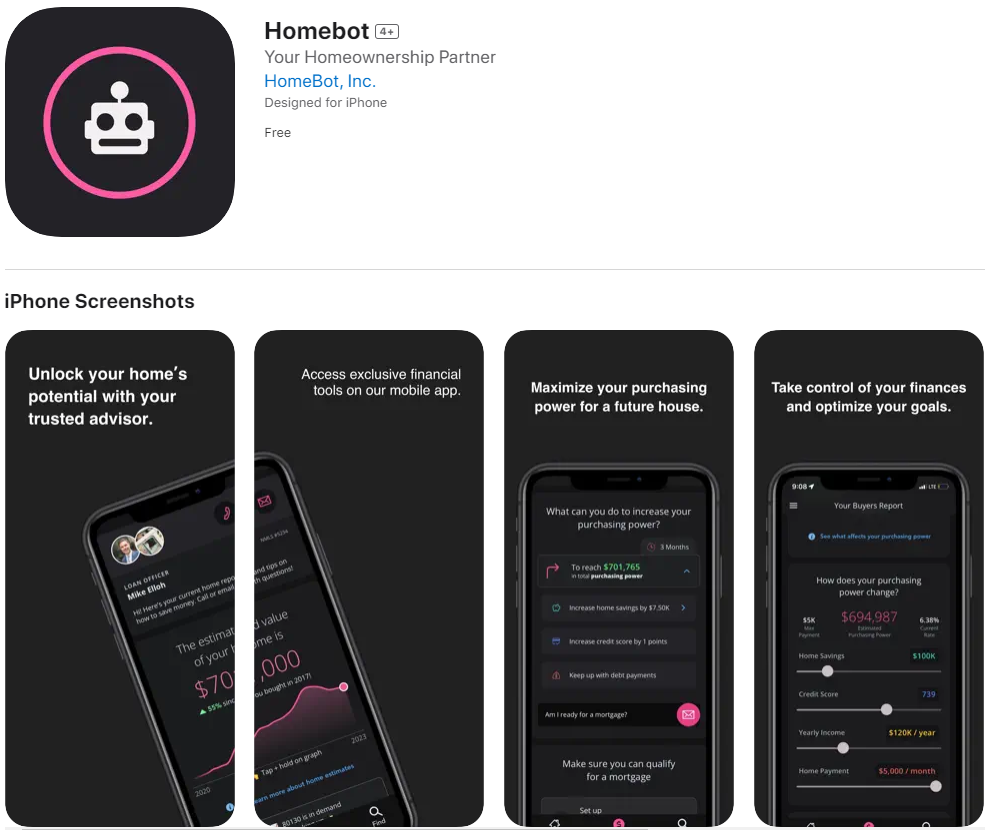

Homebot

Our Clients past and present love love love this app. Easy to use and very informative.

Homeowners Click Here For Access

Buyer Click Here for access

NWMLS

You now have direct access to the MLS. Northwest MLS is the most advanced mobile app for residential real estate in Washington state and beyond. you no longer need outdated and inaccurate info from Redfin, Zillow, etc. these companies get their info from the NWMLS

Download Here

Must use code to access: 967B592C

The Local Data

Pierce, Thurston, Kitsap Counties

Mortgage Rates Update +-

Rates unfortunanly have been on the rise the last few weeks. and experts predict they are here to stay for some time.

Mouse over and click Interactive chart for today & past rates (Turn phones sideways)

Mortgage News

Bank Rate –Expert predications on Interest Rates

Forbes – Mortgage Rate Forecast

Nerd Wallet –August Mortgage Rates Forecast: No Relief in Sight

In May and June of last year, we witnessed a significant surge in interest rates, prompting buyers to slow down their home searches. However, in January, there was a spike in mortgage loan applications with anticipation of rates falling. but they did not the first quarter enough which caused a delay in the usual mid-April surge of buyers until late May. Throughout the summer, bidding wars remained prevalent, with more pending sales than active listings daily. This indicates that buyers are now realizing the importance of securing a home despite the steady high interest rates, as housing prices continue to climb. It’s crucial to understand that interest rates are expected to climb or stay stable for some time, but housing prices will likely keep rising as inventory falls again. Buyers will need to weigh the options of purchasing at higher interest rates now to secure a home before facing another housing shortage and even higher interest rates in the future. Alternatively, they may consider buying during the peak housing inventory in mid to late summer and then refinancing when rates hopefully come down in a year or two.

Some Mortgage Loan Relief

We have partnered for years with top lenders with the cheapest rates and fees. We have always advocated to our clients that you shop mortgages to find the best rates fees and relationship . And we still hold by that; However , we did the leg will work for you years ago and brought in two mortgage brokers that are often Half Point sometimes up to a full point cheaper than many lending institutions . They also don’t charge origination fees so your fees are a lot less . Their job to shop multiple mortgage companies to find you the best rates . Majority of our clients will shop and end up working with our loan brokers. Connect with them today to see for yourself.

Tim Barlow Cornerstone Home Mortgage

360-250-3400

tim@cornerstonehomemortgage.com

https://www.cornerstonehomemortgage.com/tim/

Mark Jaimie – All Square Mortgage

253-691-3563

mjaimie@allsquaremortgage.com

National Housing News

Homebuyers Are Still More Active Than Usual

Pricing Your House Right Still Matters Today

Don’t Fall for the Next Shocking Headlines About Home Prices

Key Housing Market Trends [INFOGRAPHIC]

Homebuyers Are Getting Used to the New Normal

US Home Price Changes Forecast, and Risks

Americas housing shortage are keeping home prices high

Data Sites

County Median Home prices

Housing Shortage Tracker

Where are people buying homes

Summery:

Overall rates are up and likely here to stay for quite some time. Some say we will never see the 3% range again in our life time.

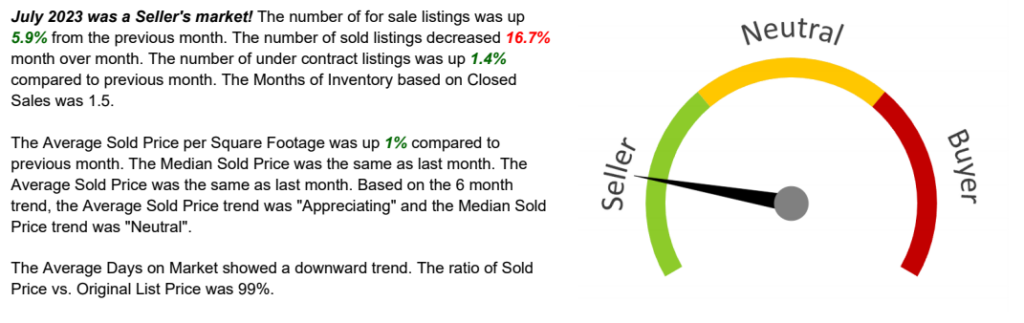

In the current housing market, sellers have shown hesitation in listing their homes, largely due to their desire to hold onto their ideal interest rates. As a result, the usual influx of inventory we typically experience during July and August has not materialized. Rising pending sales, rising price per sq ft, lower days on market in a peak season indicates buyers are coming to terms with the prevailing interest rates and heeding the advice of experts, opting to purchase properties now and consider refinancing later, before housing prices continue to climb and they find themselves burdened with higher rates and costly (bidding wars) homes of next year.

However, despite the demand from buyers, builders are struggling to keep pace with the rebounding housing market. Building permits have been on a decline for most of the year, exacerbating the housing shortage. As of last month, the deficit of available homes for sale and rentals has reached a staggering 3.8 million, underscoring the urgent need for more housing to meet the growing demand. Builders confidence is down and building permits are down 3.7% Seasonally, and at their lowest levels since 2020. Housing Starts are down 8% seasonally as well. Meaning builders are not building to pick up for demand.

In light of these dynamics, it’s crucial for prospective buyers and sellers to stay informed about the current market conditions and make informed decisions. While sellers are holding back, and builders are facing challenges, buyers who are ready to act now may benefit from securing favorable rates and prices vs next years likely much higher prices and similar interest rates. and home prices and avoiding the potential pitfalls of delayed homeownership I will predict will be a repeat of intense bidding wars and potentially higher interest rates. Keeping a close eye on market updates and expert advice can be instrumental in navigating the evolving landscape of the housing market and not getting caught up in bad and inaccurate or irrelevant media coverage.

The some relief I can see is a surge in multifamily units being built which will help the housing shortage for many that cannot buy. This will hopefully relieve some pressure in the coming years on inventory availability and prices. But this will takes years to see all completed.

View our listings

Cyrus Bonnet | CEO | Broker | Veteran

12+ Years Experience

250+ combined 5 Star Reviews

$150M+ sold

$100k Donated

PSA- Pricing Strategist Advisor

MRP- Military Relocation Professional

Connect with us

Click Here to Meet with Cyrus: Zoom, In Person, or Call

Or

call: 253-766-5133

Email: Cyrus@veteransagents.com

Or lets us contact you